News

-

FHA loans just became more affordable for Oklahoma 02/22/2023

The U.

S. Department of Housing and Urban Development (HUD) recently issued Mortgagee Letter 2023-05, which outlines a change to the Federal Housing Administration (FHA) single-family mortgage insurance policies and procedures. The key change introduced in the Mortgagee Letter will make FHA loans more affordable for Oklahoma borrowers using an FHA loan to purchase a home or refinance an existing FHA loan. The cost of the FHA Annual Mortgage Insurance Premium (also commonly called monthly mortgage insurance) will be reduced by .30 bps(0.3% of the loan balance). This change will take effect for new FHA loans with case numbers endorsed on March 20th, 2023 or later.

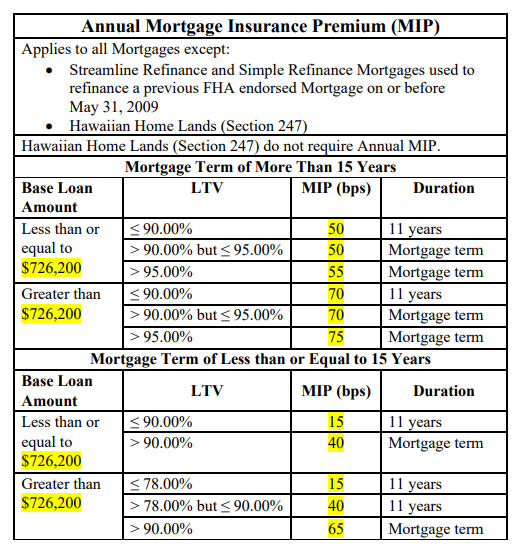

S. Department of Housing and Urban Development (HUD) recently issued Mortgagee Letter 2023-05, which outlines a change to the Federal Housing Administration (FHA) single-family mortgage insurance policies and procedures. The key change introduced in the Mortgagee Letter will make FHA loans more affordable for Oklahoma borrowers using an FHA loan to purchase a home or refinance an existing FHA loan. The cost of the FHA Annual Mortgage Insurance Premium (also commonly called monthly mortgage insurance) will be reduced by .30 bps(0.3% of the loan balance). This change will take effect for new FHA loans with case numbers endorsed on March 20th, 2023 or later.Here is an example of what the savings will look like.

Currently, on an FHA loan when the loan to value is greater than 95% and the loan is amortized for 30 years, the monthly cost for the FHA Annual Mortgage Insurance Premium is $69.75 per $100,000 that you would borrow. Starting March 20th, 2023 that will be reduced to $45.83 per $100,000 using the new .55 bps factor.

On a $425,000 loan this will be a savings of $109.22 per month!

Your annual mortgage insurance costs will vary depending on your loan-to-value ratio (LTV), the size of your down payment, and the length of your mortgage term.

Click here view Mortgagee Letter 2023-05

https://www.hud.gov/sites/dfiles/OCHCO/documents/2023-05hsgml.pdf

Reducing FHA Annual Mortgage Insurance Premium on a FHA mortgage can provide several advantages, including:

-

Lower monthly payments: By reducing the amount of FHA Annual Mortgage Insurance Premium you pay, you can lower your overall monthly mortgage payment. This can free up more of your income for other expenses, or allow you to put more money toward paying off your mortgage faster.

-

Greater purchasing power: When you have a lower monthly mortgage payment, you may be able to afford a more expensive home or borrow more money for your mortgage, giving you greater purchasing power.

-

More affordable homeownership: Lowering your mortgage insurance can make homeownership more affordable and accessible for many homebuyers, particularly those who may have been on the fence about purchasing a home due to higher payments.

-

Long-term cost savings: Over the life of a mortgage, reducing FHA Annual Mortgage Insurance Premium payments can lead to significant cost savings. For example, if you pay less in mortgage insurance each month, you may be able to pay off your mortgage sooner or put more money towards mortgage principal reductions or your retirement savings.

ReturnCall us today to take the first step.

You will be glad you did.

-